The Federal Reserve finally made its highly anticipated target funds rate cut during its September 18th Federal Open Market Committee (“FOMC”) meeting, slashing the upper bound target by 50 basis points. It’s hard to believe that this marks the first rate cut in over 4 years, particularly when you consider that markets had been in an easing cycle for the better part of the 2010 decade. Of course, this begs the question – how does this decision impact financial markets? Generally speaking, monetary easing cycles are seen as a positive for equity market performance, and this is something that we witnessed during the 2010 decade. Naturally, lower interest rates may increase borrowing power and better discount rates for stocks. Therefore, we believe it’s logical to think that equity markets will benefit from lower interest rates. However, not all easing cycles are created equal, and the FOMC generally cuts its target fed funds rate when they believe the economy is slowing.

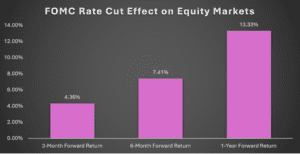

Source: Data from Bloomberg ,12/31/79 through 09/18/2024. Returns are S&P 500 Index returns and are averaged from periods in which the FOMC cut the Federal Funds Rate.

The above chart shows the average forward return series of the S&P 500 Index when the FOMC cut its target rate. As we can see, equity markets (represented by the S&P 500 Index) performed well in the short-term, medium-term, and long-term. However, we believe this answers part of the question. Certainly, on the surface, it would appear that interest rate cuts categorically benefit equity markets. That said, it’s important to dig deeper and understand whether there are certain parts of the market that benefit or suffer more or less from the broad market itself.

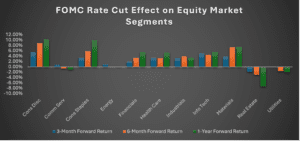

Source: Data from Bloomberg 09/12/89 through 09/18/2024 for all sectors except “Real Estate”. “Real Estate” data from 10/12/01 through 09/18/24. Returns are S&P 500 sector index returns for each of the 11 Global Industry Classification Standard (“GICS”) sectors and are averaged from periods in which the FOMC cut the Federal Funds Rate.

As we can see above, the distribution of returns among the 11 Global Industry Classification Standard (“GICS”) sectors within the S&P 500 is fairly even. There are some outliers – Consumer Discretionary and Consumer Staples performed above average, while Communication Services (formerly Telecommunications), Real Estate, and Utilities performed well below average. We believe the outlier sectors do make logical sense. We have noticed consumer cyclicals may benefit from more favorable borrowing conditions from rate cuts, while more defensive sectors may not benefit during a more “risk on” environment.

However, in our estimation, there has not been one particular group that has benefit substantially more than others as to distort the performance that equity markets have experienced in the wake of FOMC fed rate cuts. Now that we have taken a step deeper into the S&P 500 itself, let’s expand our deep dive into the FOMC cutting cycles themselves.

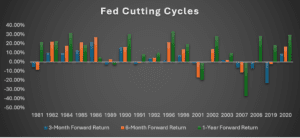

Source: Data from Bloomberg ,12/31/79 through 09/18/2024. Returns are S&P 500 Index returns and are averaged from periods in which the FOMC cut the Federal Funds Rate.

The above chart illustrates the last 18 cutting cycles from the FOMC since 1980. The common theme that we noticed is that quite a few of the cycles experienced strong short-term, medium-term, and long-term performance, while nearly all cycles experienced strong long-term performance. The outlier cases were 1986, 1989, 2001, and 2007. In the case of 1986, the long-term performance was affected by the “Black Monday” sell off in October 1987. The other three outliers preceded recessions. The notion of recession brings us back to our discussion at beginning of this article – the FOMC typically cuts rates when the economy is softening. Therefore, it’s fair to ask whether we are or are entering a recession, which is a question that economists have been pondering for the better part of 2024. At this point, many economists believe the probability of recession is fairly low, however, there are some that believe the FOMC acted too little too late. For now, early indications point towards no recession, but the risk does not appear to be 0 quite yet.

Recession aside, we do believe that interest rate cuts themselves are a bullish indicator for equities for the foreseeable. In fact, if it turns out that the FOMC was able to avoid economic recession, we believe this easing cycle will likely be the start of another strong bull market. In fact, the Federal Funds Futures market is indicating three 25 basis point rate cuts between now and the end of the calendar year with an additional five 25 basis point cuts in 2025. Absent a true economic recession, we believe an easing cycle that may result in nearly 200 basis points in cumulative rate cuts over the next 15 months may provide equity markets with the ignition to return well in excess of we have witnessed during historical easing cycles. Are more rate cuts better for furthering equity market performance?

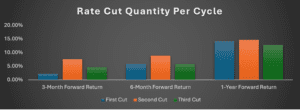

Source: Data from Bloomberg ,12/31/79 through 09/18/2024. Returns are S&P 500 Index returns and are averaged from periods in which the FOMC cut the Federal Funds Rate.

As we can see from the above chart, the law of diminishing returns does not seem to necessarily apply to additional rate cuts. While there may be overlap in returns between the first, second, and even third cut on a 1-year basis, we believe that there is enough distinction in the 3-month period where we can surmise that markets tend to respond positively to additional rate cuts within the same cycle. Therefore, we believe added performance is likely if additional rate cuts do occur within this cycle.

It remains to be seen whether or not the actions of the FOMC were swift and strong enough to avoid an economic recession. In our opinion, the answer to that question will likely be the key as to whether or not initial performance from interest rate cuts can sustain themselves and grow.

Disclosure

All discussion regarding the S&P 500 Index are for illustrative purposes only.

Global Beta Advisors LLC (“Global Beta”) is a SEC registered investment adviser headquartered in West Chester, PA. All information contained herein is for informational purposes only and does not constitute a solicitation or offer to sell any investment advisory services in any state. The investment advisory services are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation. Neither we nor our information providers shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information posted on this or any “linked” website. Before investing, consider your investment objectives and Global Beta’s fees and expenses. Please see a description of fees associated with the product on Artha’s pricing page. Global Beta’s internet-based advisory services are designed to assist clients in achieving individually separate and distinct financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see Global Beta’s Form CRS, Form ADV Part 2A, and Privacy Notice.

Artha is a brand name for the platform and is owned by Global Beta.

Past performance does not guarantee future results.

Investment Products: Are Not FDIC Insured • May Go Down in Value • Are Not a Deposit • Are Not Bank Guaranteed • Are Not Insured by any Federal Government Agency

Forward looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.