After the first fourth months of the year, we have noticed there are several headlining themes: that the market’s fate is tied directly to monetary policy, inflation may be evolving into stagflation, geopolitical conflicts hover as a risk, and technology stocks have been the darlings of 2024.

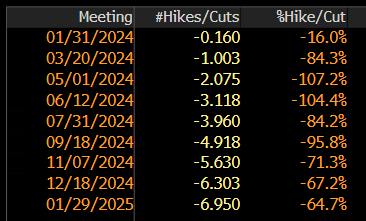

Source: Bloomberg as of 12/31/23

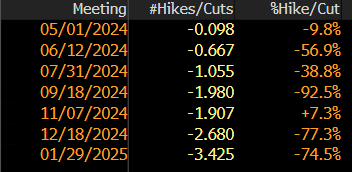

Source: Bloomberg as of 03/31/24

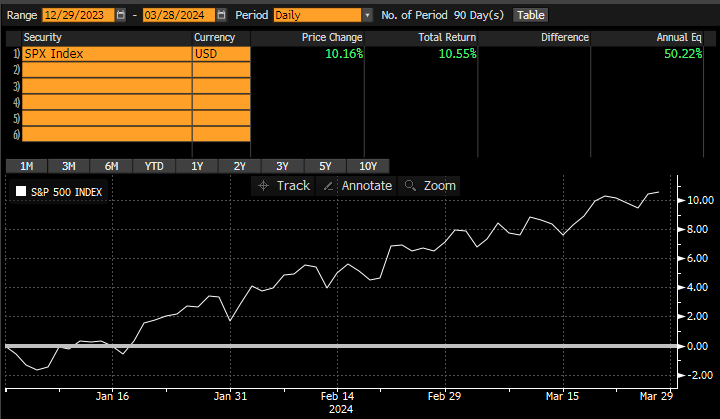

Source: Bloomberg. S&P 500 returns from 12/31/23 through 03/31/24

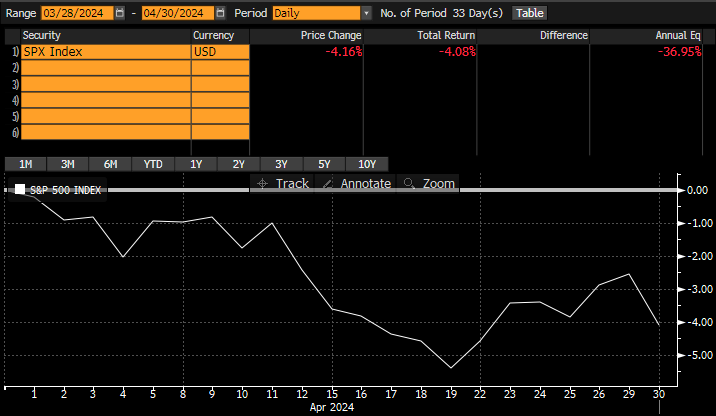

Source: Bloomberg. S&P 500 returns from 03/31/24 through 04/30/24

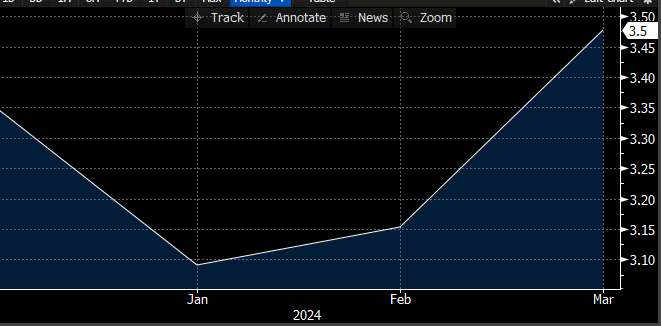

In our opinion, the first theme is a pretty convincing one as we see that at the beginning of the calendar year, the Fed Funds Futures were projecting roughly 6 interest rate cuts in 2024 with the first one expected as early as March. As we can see, the S&P 500 had a banner first quarter. Then, as the first quarter concluded, we noticed the Fed Funds Futures implied half the number of interest rate cuts for 2024 as they did to begin the year, down to less than 3 cuts with the first cut unlikely until the middle of summer. Between now and then, the Fed Funds Futures (as of 04/30/24) are now implying only two interest rate cuts with the first one expected in September, thanks in large part due to recently reported higher than expected inflation data. Since that development, the S&P 500 Index lost nearly 40% of its first quarter gains.

Source: Bloomberg year-over-year Consumer Price Index growth plotted from 12/31/23 through 04/30/24

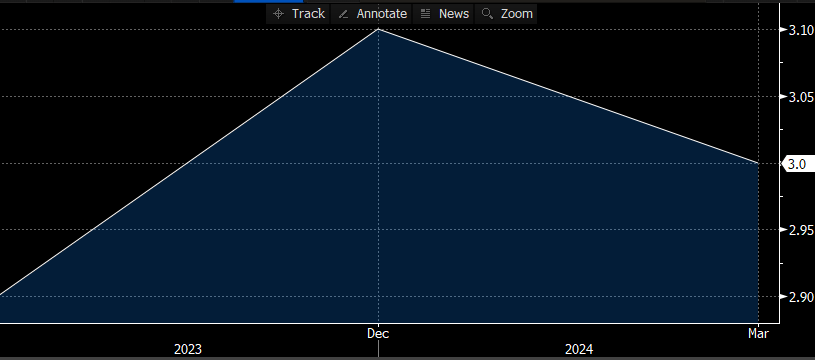

Source: Bloomberg year-over-year Gross Domestic Product growth plotted from 09/30/23 through 04/30/24

The second theme seems to be a bit of a recent trend but one that economists have feared – stagflation, which is an economic atomic bomb of persistent inflation coupled with declining economic growth. The above two graphs illustrate that condition may be unfolding. As we can see, inflation continues to be persistent between a 3% and 3.5% year-over-year growth rate. In fact, the most recent read came in higher than expectations. Additionally, the most recent GDP number (reported on 04/25/24) came in lower than expected and contracted from December’s number. Of course, it will take more than one quarter’s worth of data to make this assertion with conviction, however, the trend seems to indicate some concern.

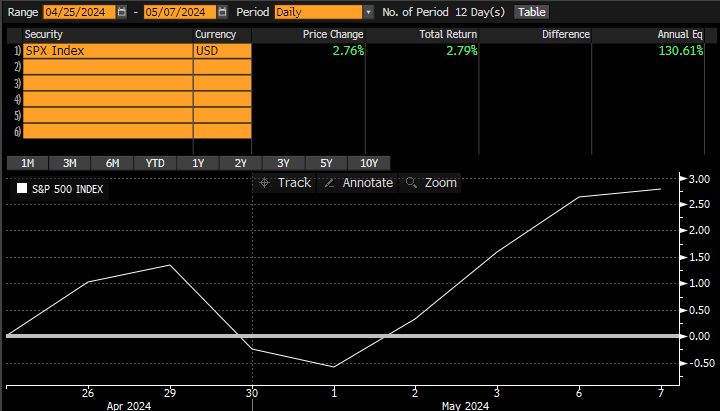

Source: Bloomberg. S&P 500 returns from 04/25/24 through 05/07/24

As discussed above, GDP was reported on 04/25/24. The S&P 500 is up nearly 3% from that point through the time this blog was written (05/07/24). We believe this is an indication that the market is not only less concerned about inflation but view a decline in GDP as hope for potential interest rate cuts.

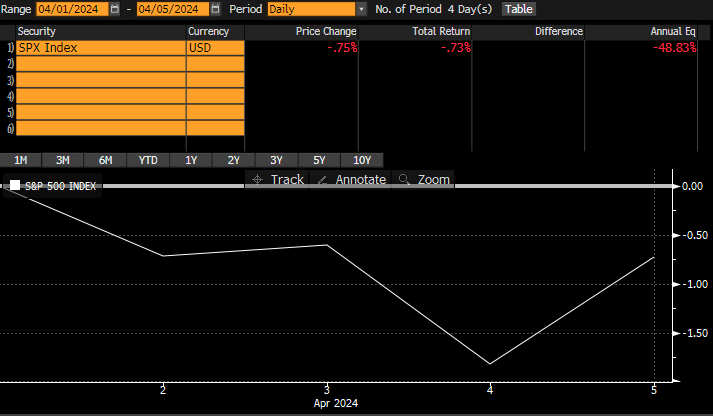

The third point is geopolitical risk, highlighted specifically by the Israel and Hamas conflict. Most recently, on April 1, Israel bombed Iran’s embassy in Damascus, which sparked concerns that the Israel/Hamas war may involve more nations and effectively become a World War.

Source: Bloomberg. S&P 500 returns from 04/01/24 through 04/05/24

The S&P 500 experienced some decline in the wake of this event; however, it is not the decline we believe we would typically see pricing in the event of a World War. Therefore, we believe that, while it remains a risk, it does not seem to be one that the market is baking in.

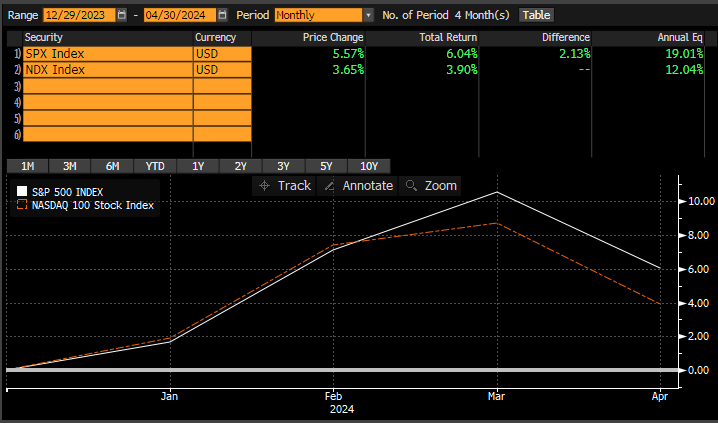

Lastly is the narrative that the market is being predominantly driven by technology stocks (specifically, AI related technology stocks). Of course, there is no question that those securities have largely contributed to the S&P 500’s recent performance as we discussed in our most recent blog. However, as we also discussed in that blog, there were indications of market breadth during the first quarter. To take it another step further, we can look at the performance of the S&P 500 versus the Nasdaq 100, which generally represents mostly technology stocks.

Source: Bloomberg. S&P 500 returns from 12/31/2023 through 04/30/24

As we can see through the plotted graph, the S&P 500’s performance exceeded the Nasdaq 100 through March and has maintained that lead through April. We believe that is further evidence that the market is not simply being led by technology or AI.

To summarize, we believe that the biggest and most impactful market risk is inflation and how it relates to monetary policy. The other themes have demonstrated some effect on the market, but it does not appear to us that any of the other three themes have the magnitude that inflation/monetary policy do. Of course, these themes could develop into stronger extremes, and thus, eventually have a stronger impact on the market. However, as it stands now, they are serving more as headline grabs than they are as market movers. That said, potential stagflation could put the Federal Reserve in a difficult position as it relates to their stance on interest rate cuts and ensuring a “soft landing”. At this point, the market seems to view this as a positive, however, we believe it will come with long-term consequences. We still believe 2-3 interest rate cuts are more likely than not in 2024 with the first one likely to occur between the July and September meetings. As discussed, we believe a move like that will have a meaningful impact (in this case, positive) on the market.