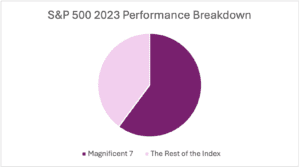

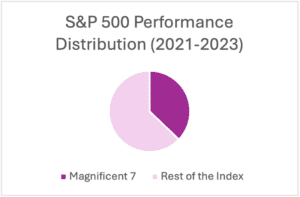

There’s no secret as to what’s been the pillar of the market – it’s been the “magnificent seven” (Microsoft, Amazon, Apple, Alphabet, Nvidia, Meta, and Tesla). After all, they have accounted for roughly 60% of the S&P 500’s banner year performance of approximately 26% in 2023. The S&P 500 is an index of securities created by Standard and Poor’s, which includes 500 leading companies and covers approximately 80% of available market capitalization.

Source: Bloomberg attribution returns derived from the underlying holdings of the SPDR S&P 500 ETF, which tracks the S&P 500 Index. As of 12/31/2023. There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

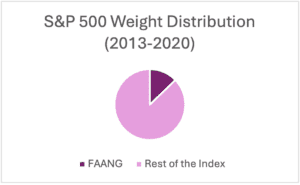

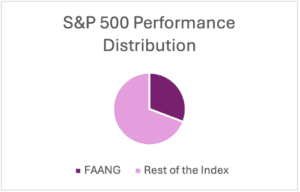

Of course, this isn’t the only example of a narrow portion of the broad market index leading the way. In fact, since the 2008 financial crisis, as the Federal Reserve first began quantitative easing and cutting interest rates, we have noticed a narrow group of stocks that have largely powered the S&P 500 Index’s performance. It began with a group of stocks (in)famously dubbed the “FAANG” stocks – Facebook (now Meta), Amazon, Apple Netflix, and Google (now Alphabet) – accounting for nearly 30% of the S&P 500 Index’s performance from 2013 through the end of 2020, despite comprising of only roughly 12% of the index’s total weight. The Magnificent seven began its prominence in 2021, which is comprised of many of the same securities, excluding Netflix and adding Microsoft, Nvidia, and Tesla.

Source: Bloomberg. Data between 1/1/2013 through 12/31/2020. Weight measured by the sum of the average weight from 2013-2020. Returns measured by attribution returns derived from the underlying holdings of the SPDR S&P 500 ETF, which tracks the S&P 500 Index. “FAANG” was an acronym for “Facebook”(now “Meta”), Amazon, Apple, Netflix, and Google (now “Alphabet”). There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

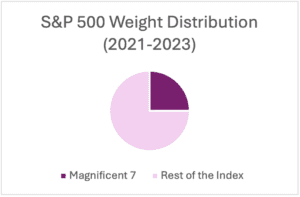

Source: Bloomberg. Data between 1/1/2021 through 12/31/2023Weight measured by the sum of the average weight from 2021-2023. Returns measured by attribution returns derived from the underlying holdings of the SPDR S&P 500 ETF, which tracks the S&P 500 Index. “Magnificent 7” is term to describe Meta, Amazon, Apple, Alphabet, Microsoft, Tesla, and Nvidia. There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

As we can see, the small subset of securities continues grew to a larger part of the index as the Magnificent 7 comprises of roughly ¼ of the S&P 500’s weight with about 37% of the performance over the past 3 calendar years. Granted, there are two more securities in the Magnificent 7 than there were with the FAANG stocks, but it still represents nearly twice the size of what FAANG represented in the S&P 500 and is only 7 of the 500 stocks. We believe the concentration growth over the past 10 years cannot be denied when you examine the evolution of the “mega tech” movement.

How does this phenomenon happen and continue to persist?

It’s a combination of many factors, but generally, lower interest rate environments make it easier for larger companies to raise capital and continue to invest in growth segments of their market, such as Microsoft’s investment in OpenAI. In fact, the magnificent seven collectively spent nearly a quarter of a trillion dollars in mergers and acquisitions over the past 5 years (source: Bloomberg). That accounts for about 2% of all mergers and acquisitions done in the entire U.S (source: Bloomberg). We believe that amount of spending to grow conglomerate companies such as those can drive serious growth rates, which we have noticed is a significant component for asset managers and indexers.

How do asset managers and indexers impact concentrated performance?

In short, these companies may become a self fulfilling prophecy. As their growth rates potentially attract investments from large asset managers (e.g.: as a byproduct of index inclusion in an index such as the S&P 500), their market capitalization begins to grow. In our estimation, the largest indexes are still weighted by market capitalization, and thus, as their market capitalization grows, so does the proportionate weight of the stock. When we couple that with the fact that an increase in market capitalization equates to the stock’s performance, we believe the index has created a snowball effect. Therefore, the more the company’s market capitalization grows, the more impact it has on an index, especially an index that is weighted by market capitalization.

Source: Morningstar, as of December 31, 2022.

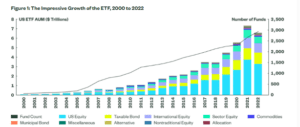

If we just examine the meteoric growth in the Exchange Traded Fund (“ETF”) industry, we can see the level of impact that index tracked assets may have on this concentration phenomenon. As shown in the above chart, the number of ETFs issued over the past 5 years alone has roughly doubled. What does that mean? It means that more institutional investors (i.e.: fund managers of these ETFs) may be bidding on generally the same stocks as many of these ETFs are tracking indexes that hold these stocks.

Then why Index to 500 stocks?

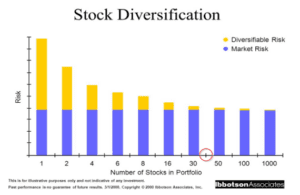

If history (both current and long term) show such persistent concentration, why would an investor want to be indexed to 500 stocks? On the surface, asset managers may suggest that more stocks lead to higher diversification, which may provide aversion to risk. However, we have noticed several studies that indicate an index of just 30-50 stocks may be the inflection point of diversification and that any increase in the number of stocks in an index is subject to the law of diminishing returns.

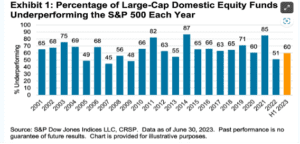

If we are to understand that diversification can be achieved with less securities, and that there is such a concentration of performance among a small number of stocks, we believe it may be prudent to focus investment allocations towards small subsets of stocks so that your portfolio is not over diversified, and thus, potentially subject to performance dilution. However, we can’t ignore how difficult it has been to traditionally outperform the S&P 500 Index. In fact, in most years, more active managers than not have underperformed the S&P 500 Index.

There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

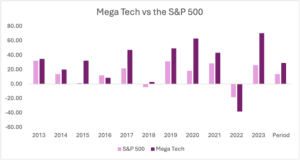

We believe the above charge is a remarkable representation of how difficult it has been to beat the S&P 500. In fact, it would seem the S&P 500’s dominance is so supreme that the only investment that may routinely beat the S&P 500 is itself.

Source: Bloomberg attribution returns derived from the underlying holdings of the SPDR S&P 500 ETF, which tracks the S&P 500 Index. Data between 1/1/2013 through 12/31/2023. “Mega Tech” is defined as the FAANG (Facebook, Amazon, Apple, Netflix, and Google) from 2013-2020 and as the Magnificent 7 (Meta, Amazon, Apple, Microsoft, Tesla, Nvidia, and Alphabet) from 2021-2023. Performance for “Mega Tech” was calculated by the performance of those stocks in that time frame by prorating their weight to 100%. There is no guarantee that the investment objectives will be achieved. Moreover, the past performance is not a guarantee or indicator of future results.

As we circle back to our initial discussion around the concentration impact on the S&P 500, we again notice that it may be more impactful to be targeted in our investment approach. As we can see here, if we indexed to just the “mega tech” stocks over the past 10 years, we would have actually outperformed the index by quite a wide margin. This is not to say that this strategy will work to this effect all of the time and this routinely, but it’s an illustration of just how impactful one group of stocks can be over a broad index of stocks.

Should you follow the trend?

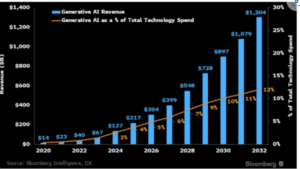

The old adage of “the trend is your friend” may be in full effect here. While we believe there is merit in that saying, it does come with caution. We believe every stock is prone to a correction, however, we believe there may be staying power for the Magnificent 7, similar to the dot com cohort of the late 1990s/early 2000s. We believe we are still very much in the embryotic stage of development in Artificial Intelligence and think that the Magnificent 7, especially with their buying power, will lead the charge. If we are to believe that investment in AI will continue (particularly from this group), the spending may create a burgeoning industry of itself, potentially introducing a new guard of additional stocks to help lead the index. According to Bloomberg intelligence, generative AI is expected to become a $1.3 trillion dollar market by 2032, and as such, become a large part of technology spend.

Projection measured as of 06/01/2023.

We believe that forecasts are always difficult to project, especially in a new industry, but we believe stock market performance generally signals expectations, and given the concentration of recent market performance, it is possible that we are on the verge of expansive growth in Artificial Intelligence. We believe time will tell, but in our opinion, it’s always important to understand what’s under the hood of your investment portfolio.

Learn more about Artha and get started with a free account.

Global Beta Advisors LLC (“Global Beta”) is a SEC registered investment adviser headquartered in North Wales, PA. Registration with the SEC as an investment adviser does not imply a certain level of skill or training. All information contained herein is for informational purposes only and does not constitute a solicitation or offer to sell any investment advisory services in any state. The investment advisory services are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation. Neither we nor our information providers shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information posted on this or any “linked” website.

Before investing, consider your investment objectives and Global Beta’s fees and expenses. Please see a description of fees associated with the product on Artha’s pricing page. Global Beta’s internet-based advisory services are designed to assist clients in achieving individually separate and distinct financial goals. They are not intended to provide comprehensive tax advice or financial planning with respect to every aspect of a client’s financial situation and do not incorporate specific investments that clients hold elsewhere. For more details, see Global Beta’s Form CRS, Form ADV Part 2A, and Privacy Notice. Artha is a brand name for the platform and is owned by Global Beta.

Past performance does not guarantee future results.

Investment Products: Are Not FDIC Insured • May Go Down in Value • Are Not a Deposit • Are Not Bank Guaranteed • Are Not Insured by any Federal Government Agency

General Risk of Investing

Investing in securities involves risk of loss that clients should be prepared to bear. We do not represent or guarantee the future performance of any client account or portfolio, that our services or methods of analysis can or will predict future results, successfully identify market tops or bottoms, insulate clients from losses due to market corrections or declines, or that your financial goals and objectives will be met. Past performance is in no way an indication of future performance. Clients must understand that investments made pursuant to its investment advisory services involve risk and should carefully consider the risks and uncertainties described below before investing. There could be additional risks and uncertainties that we are unaware of, or even deem immaterial, that may become important factors that adversely impact client investments. All forms of securities may decline in value due to factors affecting securities markets generally, such as real or perceived adverse economic, political, or regulatory conditions, inflation, changes in interest or currency rates or adverse investor sentiment. Adverse market conditions may be prolonged and may not have the same impact on all types of securities. The values of securities may fall due to factors affecting a particular issuer, industry or the securities market as a whole.

Forward Looking Statements

The presentations included on this website may contain “forward-looking statements” which are based on Global Beta’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available to Global Beta. Current and prospective clients are cautioned not to put undue reliance on such forward-looking statements, which are not a guarantee of future performance, and are subject to a number of uncertainties and other factors, many of which are outside Global Beta’s control, which could cause actual results to differ materially from such statements. Any forward-looking statements speak only as of the date they are made and Global Beta assumes no duty to and does not undertake to update forward-looking statements.