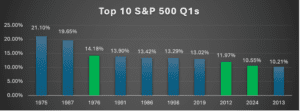

The S&P 500 experienced its 9th best first quarter return since 1970, finishing with a 10.55% return for the first quarter of the year.

Source: Bloomberg. First quarter returns from 1/1/1970 through 03/31/2024. Green bars represent election years.

As we can see from the above chart, 3 of the top 10 S&P 500 first quarters were election years, which includes this year. We believe this is an important distinction because we have noticed that incumbent administrations generally attempt to implement policies that are more likely to create stable economic and market conditions. As we discussed in March, there has historically been a correlation between really strong starts to the year and strong overall years. However, a common fear and misconception is that much of the performance is coming from such a small part of the market.

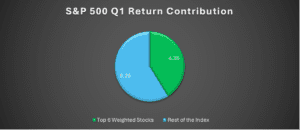

Source: Bloomberg. Returns from 1/1/24 through 03/31/24. “Top 6 Weighted Stocks” are the combined weighted average returns of Nvidia, Microsoft, Apple, Meta Platforms, Amazon and Alphabet within the S&P 500. “Rest of the Index” are the combined weighted average returns of all other stocks in the S&P 500

As we can see from the above chart, over 40% of the S&P 500’s first quarter return came from its 6 highest weighted securities, so there is plenty of reason for concern that we are experiencing a narrow market. In fact, Nvidia alone accounted for roughly 25% of the S&P 500’s first quarter return. However, while only a handful of stocks in the index make up such a large portion of the pie, the pie itself was quite large during the first quarter. Additionally, because the S&P 500 is weighted by market capitalization, those six securities, through their growth in market capitalization over the past few years, have grown to be such a large part of the index that their contributions are going to affect the index’s performance more than other members of the index (which we spoke about here).

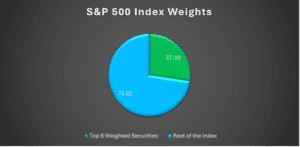

Source: Bloomberg. Returns from 1/1/24 through 03/31/24. “Top 6 Weighted Stocks” are the combined average weights of Nvidia, Microsoft, Apple, Meta Platforms, Amazon and Alphabet within the S&P 500. “Rest of the Index” are the combined average weights of all other stocks in the S&P 500

As we can see from the above chart, over 1/4 of the S&P 500 Index is comprised of these 6 stocks. This is part of the reason the rest of the index is overlooked or is assumed to be the only movers in the market. In fact, the first quarter featured a lot of strong performing stocks within the S&P 500 Index.

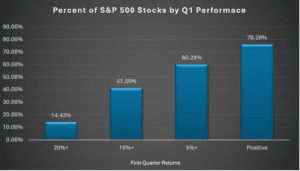

Source: Bloomberg. Percent of stocks in the S&P 500 by their returns from 1/1/2024 through 3/31/2024

In order to get a sense of the breadth of the market, we looked at how each stock in the S&P 500 returned for the first quarter. As you can see, over 40% of the stocks had a 10% return or better, nearly 2/3 of the stocks had a 5% return or better, and over 3/4 of the stocks were positive for the quarter. Of course, this is a significant revelation because it points back to our previous point that the reason the 6 stocks have been the S&P 500’s largest contributors is mostly due to their weightings in the index than their performance. This is why it’s important to dig into the attribution of the index to identify exactly what’s going on because headlines and narratives may often create an illusion that masks reality. If we are to operate under the assumption that 6 stocks, and only 6 stocks, are responsible for the market’s gains; it can create fear and anxiety that the market is not fully supported, and that can lead to false assumptions and missed opportunities. It’s our mission to identify what is actually going on and paint a broader picture.

In our view, this is further evidence that we are experiencing broadening performance in 2024, which is much different than what we saw in 2023, where the “Magnificent 7” (Apple, Microsoft, Tesla, Amazon, Nvidia, Alphabet, and Meta Platforms) drove much of the market as we discussed here. We believe this distinction is important because we have noticed that market breadth generally supports market momentum for longer periods of time. This is why we believe that market momentum will persist at least through 2024.