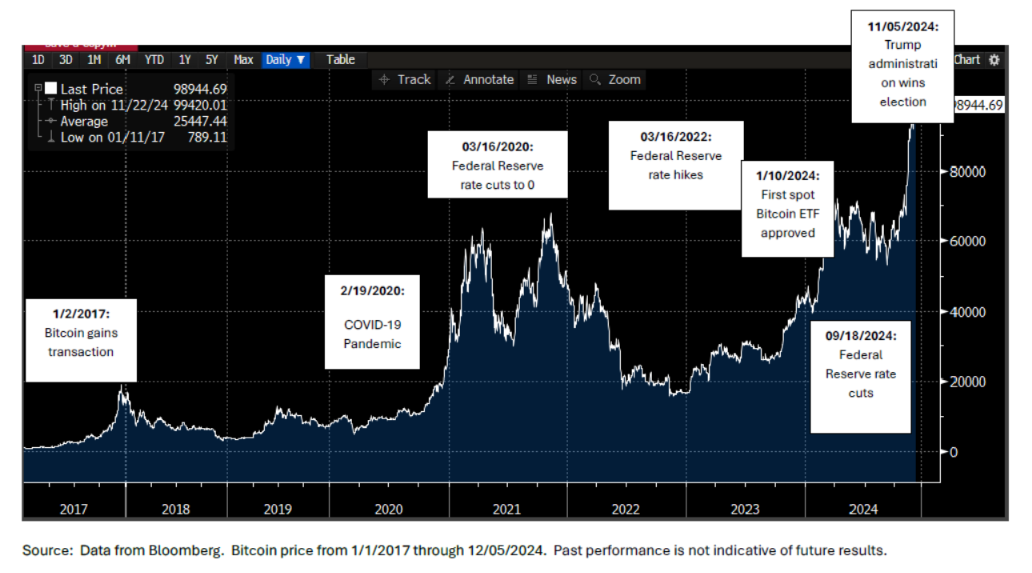

Bitcoin advocates rejoiced on Thursday (12/05/24) as Bitcoin crossed the $100,000 mark for the first time. It has since teetered above and below the milestone, but the milestone was finally achieved after Bitcoin enthusiasts had been touting this mark for years. However, as those who track the asset closely understand, it has certainly been a long and windy road. Bitcoin was first launched in January 2009 by an anonymous developer under the pseudonym, Satoshi Nakamoto. However, we believe the digital coin did not pick up popularity until around 2017. There have been quite a few events that have occurred, which have directly impacted the trajectory of Bitcoin and Crypto currency in general. In fact, its current standing and recent run up is directly tied to potential legislation from the incoming administration. Let’s take a look at the timeline of events overlayed with the performance of Bitcoin. This will allow us to try to make some assumptions as to where Bitcoin and Crypto may go from here.

As we can see, there were quite a number of events that have occurred over the past 7 years, which appear to have had a significant impact on the price of Bitcoin. Let’s break them down.

As we can see, there were quite a number of events that have occurred over the past 7 years, which appear to have had a significant impact on the price of Bitcoin. Let’s break them down.

We first examine the long-term relationship between the two asset classes. In this case, we will examine back to 2017, when we believe Bitcoin first began to gain real traction. As we can see from above, Bitcoin’s upside is in excess of equities (as measured by the S&P 500) and its downside is also better than equities. We believe Bitcoin enthusiasts will point to the lower downside capture and say that Bitcoin is a store of value. However, this does not paint the entire picture, which is why we included the asset’s correlation relative to equities. As we can see, in the long term, the correlation between the two asset classes is quite low. Therefore, even if Bitcoin is outperforming the S&P 500 in equity downturns, it may not be a systematic effect. That is to say that there isn’t enough of a relationship to suggest that Bitcoin is a flight to safety from equities.

We first examine the long-term relationship between the two asset classes. In this case, we will examine back to 2017, when we believe Bitcoin first began to gain real traction. As we can see from above, Bitcoin’s upside is in excess of equities (as measured by the S&P 500) and its downside is also better than equities. We believe Bitcoin enthusiasts will point to the lower downside capture and say that Bitcoin is a store of value. However, this does not paint the entire picture, which is why we included the asset’s correlation relative to equities. As we can see, in the long term, the correlation between the two asset classes is quite low. Therefore, even if Bitcoin is outperforming the S&P 500 in equity downturns, it may not be a systematic effect. That is to say that there isn’t enough of a relationship to suggest that Bitcoin is a flight to safety from equities.

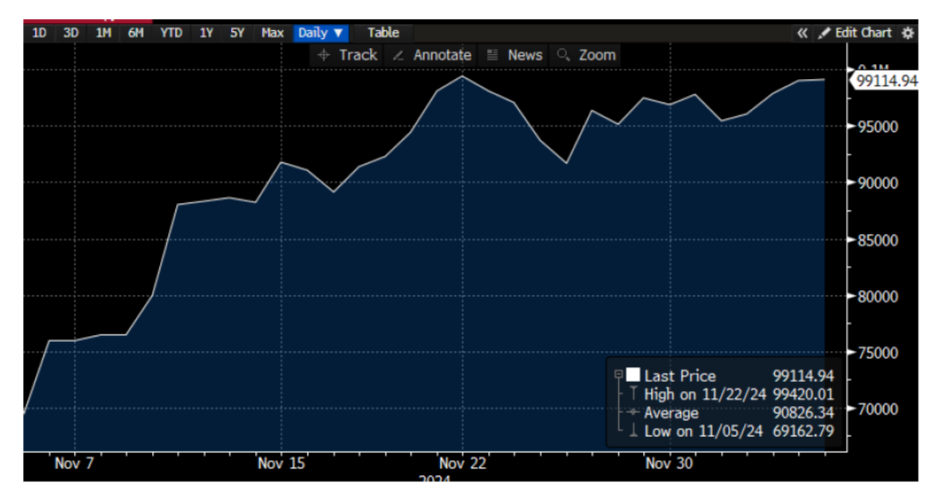

Now we examine how the asset classes responded during the first true bear market of the digital asset’s existence. Its upside is certainly muted relative to the long-term average that we observed above, but its downside is again better. The correlation between the two assets was higher than it has been long-term. We believe this is largely due to the fact that every asset class suffered during the depths of the COVID-19 related bear market. It does seem that, in this case, Bitcoin was able to provide a bit more stability than equities.

Now we examine how the asset classes responded during the first true bear market of the digital asset’s existence. Its upside is certainly muted relative to the long-term average that we observed above, but its downside is again better. The correlation between the two assets was higher than it has been long-term. We believe this is largely due to the fact that every asset class suffered during the depths of the COVID-19 related bear market. It does seem that, in this case, Bitcoin was able to provide a bit more stability than equities.

As we know, the Federal Reserve began cutting interest rates in the wake of the COVID-19 related pandemic. Many investors also enjoyed one of the better bull market cycles that equity markets have ever experienced. Despite equity markets enjoying the benefits of interest rate cuts, Bitcoin was an even larger benefactor of the easing cycle. We believe this is partly due to the extreme risk on appetite of investors looking for alternative means to return as equity market valuations began to balloon. However, correlation between the two asset classes receded back closer to their long-term average. Although both asset classes seem to respond well to risk on events, the correlation between the two was on the weaker side.

As we know, the Federal Reserve began cutting interest rates in the wake of the COVID-19 related pandemic. Many investors also enjoyed one of the better bull market cycles that equity markets have ever experienced. Despite equity markets enjoying the benefits of interest rate cuts, Bitcoin was an even larger benefactor of the easing cycle. We believe this is partly due to the extreme risk on appetite of investors looking for alternative means to return as equity market valuations began to balloon. However, correlation between the two asset classes receded back closer to their long-term average. Although both asset classes seem to respond well to risk on events, the correlation between the two was on the weaker side.

Contrary to the period we just examined, we now look at how the two asset classes behaved during a tightening cycle. In this case, Bitcoin is capturing approximately the same upside effects as equities but with slightly higher downside. Correlations between the two asset classes did pick up a bit during this period vs their long-term average. In our opinion, rising rates certainly appeared to affect both asset classes negatively, and while the downside was modestly higher, we noticed Bitcoin was quite volatile during the period.

Contrary to the period we just examined, we now look at how the two asset classes behaved during a tightening cycle. In this case, Bitcoin is capturing approximately the same upside effects as equities but with slightly higher downside. Correlations between the two asset classes did pick up a bit during this period vs their long-term average. In our opinion, rising rates certainly appeared to affect both asset classes negatively, and while the downside was modestly higher, we noticed Bitcoin was quite volatile during the period.

Arguably the most significant event to happen to Bitcoin to date was the approval of the first spot Bitcoin ETF. The Securities Exchange Commission, which had echoed negative sentiment around the concept of crypto currencies, effectively endorsed Bitcoin by approving it to be offered in an ETF wrapper. We believe this created a significant event as ETFs are a heavily used investment vehicle by both institutional and retail investors. We also believe this dispelled the narrative that Bitcoin is a speculative asset. With institutional support with the launch of Bitcoin related ETFs, it seems to have created some type of floor for the price of Bitcoin. As we can see, Bitcoin benefited both to the upside and the downside relative to equities in the wake of this event.

Arguably the most significant event to happen to Bitcoin to date was the approval of the first spot Bitcoin ETF. The Securities Exchange Commission, which had echoed negative sentiment around the concept of crypto currencies, effectively endorsed Bitcoin by approving it to be offered in an ETF wrapper. We believe this created a significant event as ETFs are a heavily used investment vehicle by both institutional and retail investors. We also believe this dispelled the narrative that Bitcoin is a speculative asset. With institutional support with the launch of Bitcoin related ETFs, it seems to have created some type of floor for the price of Bitcoin. As we can see, Bitcoin benefited both to the upside and the downside relative to equities in the wake of this event.

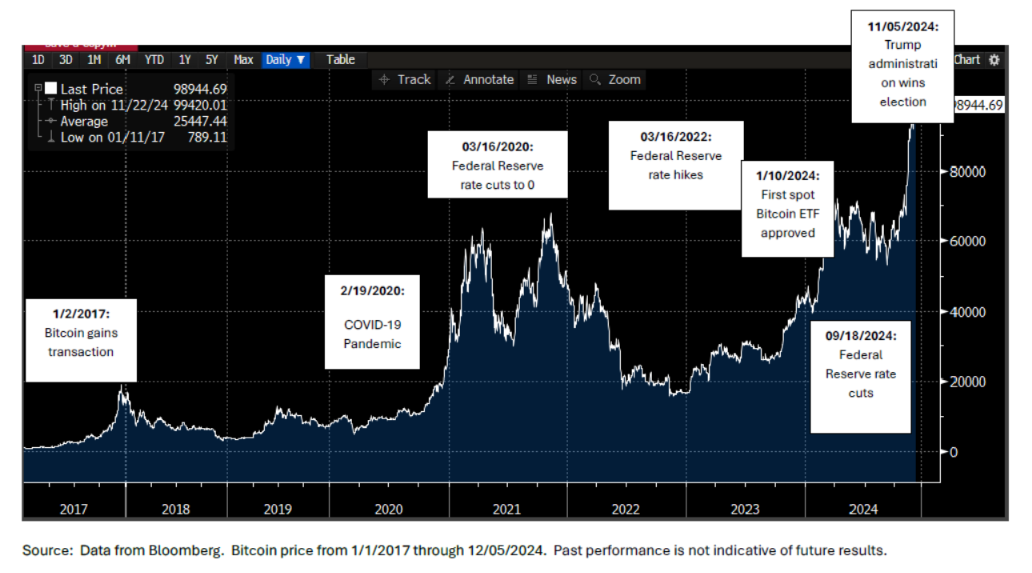

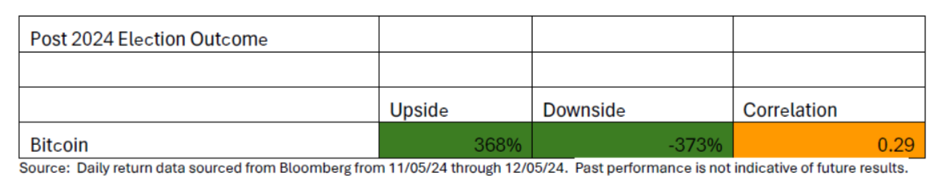

Lastly, we examine the importance of the outcome from the election. As we discussed, the new administration has been vocal advocates of Bitcoin and Crypto currency in general. As we saw earlier, Bitcoin has essentially been on a straight ride up since the election, given the positive sentiment that the new administration has provided around the prospects of Bitcoin and Crypto. As expected, we can see its up capture shot up exponentially versus equities and its downside turned significantly negative. Additionally, correlations between the two assets dropped to around its long-term historical average. In essence, Bitcoin has had a mind of its own over the past month as it has been responding more from idiosyncratic factors than systematic ones.

Lastly, we examine the importance of the outcome from the election. As we discussed, the new administration has been vocal advocates of Bitcoin and Crypto currency in general. As we saw earlier, Bitcoin has essentially been on a straight ride up since the election, given the positive sentiment that the new administration has provided around the prospects of Bitcoin and Crypto. As expected, we can see its up capture shot up exponentially versus equities and its downside turned significantly negative. Additionally, correlations between the two assets dropped to around its long-term historical average. In essence, Bitcoin has had a mind of its own over the past month as it has been responding more from idiosyncratic factors than systematic ones.

As we can see, there were quite a number of events that have occurred over the past 7 years, which appear to have had a significant impact on the price of Bitcoin. Let’s break them down.

As we can see, there were quite a number of events that have occurred over the past 7 years, which appear to have had a significant impact on the price of Bitcoin. Let’s break them down.

COVID-19 Pandemic:

This appears to have really jump started the Bitcoin mania. Until that point, Bitcoin had really been trading flat. It seemed that pandemic driven lockdowns and stimulus led to new investors coming into the markets. While this certainly drove up all asset classes, new investors seemed to really gravitate towards more speculative assets that were more novel in nature, which led to an apparent increase in demand for Bitcoin. As we can see from the chart above, the price of Bitcoin began to rise in the wake of the Pandemic.Federal Reserve Cuts Rates to 0:

While this goes hand in hand with the pandemic, the Federal Reserve cut interest rates to 0, which enabled increased borrowing power for investors. As investors began to borrow at these lower rates, it appears the leverage was used to purchase higher beta assets, such as Bitcoin, to net higher returns. As we can see from the chart above, the price of Bitcoin continued to rise at all-time highs.Federal Reserve Increases Rates for the first time since pre-Pandemic:

This is where the gravy train took a tumble. As borrowing costs began to rise, some of the speculative assets purchased at the height of the easing cycle began to sell off as monetary policy began to tighten. It seemed that the increase in borrowing costs began to squeeze many institutional investors into these sales, which ultimately derailed Bitcoin. As the chart shows, Bitcoin began to tumble and had stayed down for quite a bit.First Spot Bitcoin Exchange Traded Fund (“ETF”) Approved:

Although the first Bitcoin ETF wasn’t approved until January 2024, there was speculation for several months that the approval was coming, which is why we saw the price of Bitcoin run up in advance of the official approval.Federal Reserve Begins Cutting Rate:

For the first time in over 2 years, the Federal Reserve began cutting interest rates as they deemed to have finally gotten inflation under control. The easing cycle re-enabled borrowing, and thus, more money supply to enter the markets. As a result, we have seen Bitcoin (along with most asset classes) benefit from the beginning of this easing cycle.Trump Administration wins the election:

While Bitcoin has widely been viewed by regulators and the Federal Reserve itself as a speculative asset, many Bitcoin and Crypto advocates would suggest that it is the future for currency and will overtake fiat currency. Of course, this would require government cooperation. As many have seen, the Trump administration has begun selecting pro Crypto currency members to its cabinet, such as Elon Musk (head of the newly created Department of Government Efficiency) and David Sacks (head of the newly created “A.I. and Crypto Czar”). While it’s not entirely clear what Trump or any of his cabinet members will do as for as the U.S. adopting Crypto currency, both Musk and Sacks have been clear advocates of it as a replacement to fiat. In fact, Musk has been an outspoken proponent that Crypto can help solve the nation’s debt crisis. Although this all remains to be seen, Bitcoin has jumped nearly 43% from election day through 12/5/24.

Source: Data from Bloomberg. Bitcoin price from 11/05/2024 through 12/05/2024. Past performance is not indicative of future results.

How does this impact the rest of the markets?

We have noticed that many financial professionals view Bitcoin as a “risk on” asset, despite its description as a “digital currency”. As such, if Bitcoin is performing well, it may suggest that equities are/will perform well. In our opinion, Bitcoin seems to take leadership from equities more than the other way around; however, in either case, it’s important to examine the relationship between the two asset classes. Because Bitcoin is the focal point of media attention, we believe it’s fair to wonder how the impact of Bitcoin reaching its $100k milestone may impact equity markets. Let’s examine Bitcoin’s correlation and relative performance to equities within each scenario we discussed above.Since 2017

We first examine the long-term relationship between the two asset classes. In this case, we will examine back to 2017, when we believe Bitcoin first began to gain real traction. As we can see from above, Bitcoin’s upside is in excess of equities (as measured by the S&P 500) and its downside is also better than equities. We believe Bitcoin enthusiasts will point to the lower downside capture and say that Bitcoin is a store of value. However, this does not paint the entire picture, which is why we included the asset’s correlation relative to equities. As we can see, in the long term, the correlation between the two asset classes is quite low. Therefore, even if Bitcoin is outperforming the S&P 500 in equity downturns, it may not be a systematic effect. That is to say that there isn’t enough of a relationship to suggest that Bitcoin is a flight to safety from equities.

We first examine the long-term relationship between the two asset classes. In this case, we will examine back to 2017, when we believe Bitcoin first began to gain real traction. As we can see from above, Bitcoin’s upside is in excess of equities (as measured by the S&P 500) and its downside is also better than equities. We believe Bitcoin enthusiasts will point to the lower downside capture and say that Bitcoin is a store of value. However, this does not paint the entire picture, which is why we included the asset’s correlation relative to equities. As we can see, in the long term, the correlation between the two asset classes is quite low. Therefore, even if Bitcoin is outperforming the S&P 500 in equity downturns, it may not be a systematic effect. That is to say that there isn’t enough of a relationship to suggest that Bitcoin is a flight to safety from equities.

COVID-19 Bear Market

Now we examine how the asset classes responded during the first true bear market of the digital asset’s existence. Its upside is certainly muted relative to the long-term average that we observed above, but its downside is again better. The correlation between the two assets was higher than it has been long-term. We believe this is largely due to the fact that every asset class suffered during the depths of the COVID-19 related bear market. It does seem that, in this case, Bitcoin was able to provide a bit more stability than equities.

Now we examine how the asset classes responded during the first true bear market of the digital asset’s existence. Its upside is certainly muted relative to the long-term average that we observed above, but its downside is again better. The correlation between the two assets was higher than it has been long-term. We believe this is largely due to the fact that every asset class suffered during the depths of the COVID-19 related bear market. It does seem that, in this case, Bitcoin was able to provide a bit more stability than equities.

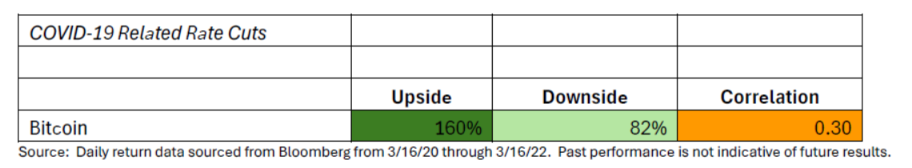

COVID-19 Related Rate Cuts

As we know, the Federal Reserve began cutting interest rates in the wake of the COVID-19 related pandemic. Many investors also enjoyed one of the better bull market cycles that equity markets have ever experienced. Despite equity markets enjoying the benefits of interest rate cuts, Bitcoin was an even larger benefactor of the easing cycle. We believe this is partly due to the extreme risk on appetite of investors looking for alternative means to return as equity market valuations began to balloon. However, correlation between the two asset classes receded back closer to their long-term average. Although both asset classes seem to respond well to risk on events, the correlation between the two was on the weaker side.

As we know, the Federal Reserve began cutting interest rates in the wake of the COVID-19 related pandemic. Many investors also enjoyed one of the better bull market cycles that equity markets have ever experienced. Despite equity markets enjoying the benefits of interest rate cuts, Bitcoin was an even larger benefactor of the easing cycle. We believe this is partly due to the extreme risk on appetite of investors looking for alternative means to return as equity market valuations began to balloon. However, correlation between the two asset classes receded back closer to their long-term average. Although both asset classes seem to respond well to risk on events, the correlation between the two was on the weaker side.

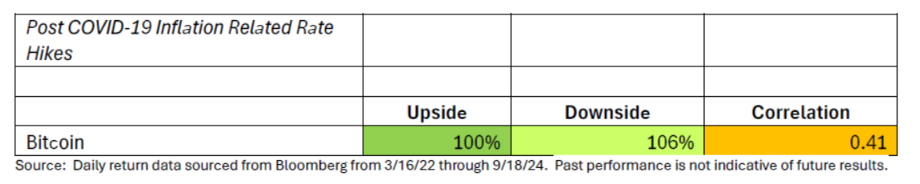

Post COVID-19 Inflation Related Interest Rate Hikes

Contrary to the period we just examined, we now look at how the two asset classes behaved during a tightening cycle. In this case, Bitcoin is capturing approximately the same upside effects as equities but with slightly higher downside. Correlations between the two asset classes did pick up a bit during this period vs their long-term average. In our opinion, rising rates certainly appeared to affect both asset classes negatively, and while the downside was modestly higher, we noticed Bitcoin was quite volatile during the period.

Contrary to the period we just examined, we now look at how the two asset classes behaved during a tightening cycle. In this case, Bitcoin is capturing approximately the same upside effects as equities but with slightly higher downside. Correlations between the two asset classes did pick up a bit during this period vs their long-term average. In our opinion, rising rates certainly appeared to affect both asset classes negatively, and while the downside was modestly higher, we noticed Bitcoin was quite volatile during the period.

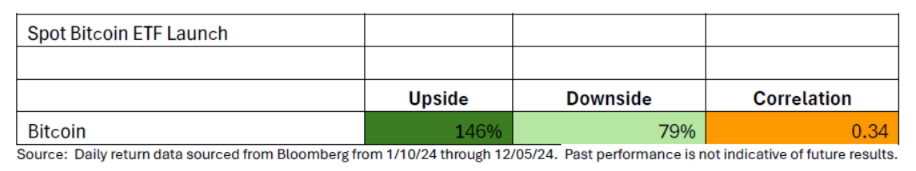

Spot Bitcoin Exchange Traded Fund (“ETF”) Launch

Arguably the most significant event to happen to Bitcoin to date was the approval of the first spot Bitcoin ETF. The Securities Exchange Commission, which had echoed negative sentiment around the concept of crypto currencies, effectively endorsed Bitcoin by approving it to be offered in an ETF wrapper. We believe this created a significant event as ETFs are a heavily used investment vehicle by both institutional and retail investors. We also believe this dispelled the narrative that Bitcoin is a speculative asset. With institutional support with the launch of Bitcoin related ETFs, it seems to have created some type of floor for the price of Bitcoin. As we can see, Bitcoin benefited both to the upside and the downside relative to equities in the wake of this event.

Arguably the most significant event to happen to Bitcoin to date was the approval of the first spot Bitcoin ETF. The Securities Exchange Commission, which had echoed negative sentiment around the concept of crypto currencies, effectively endorsed Bitcoin by approving it to be offered in an ETF wrapper. We believe this created a significant event as ETFs are a heavily used investment vehicle by both institutional and retail investors. We also believe this dispelled the narrative that Bitcoin is a speculative asset. With institutional support with the launch of Bitcoin related ETFs, it seems to have created some type of floor for the price of Bitcoin. As we can see, Bitcoin benefited both to the upside and the downside relative to equities in the wake of this event.

Lastly, we examine the importance of the outcome from the election. As we discussed, the new administration has been vocal advocates of Bitcoin and Crypto currency in general. As we saw earlier, Bitcoin has essentially been on a straight ride up since the election, given the positive sentiment that the new administration has provided around the prospects of Bitcoin and Crypto. As expected, we can see its up capture shot up exponentially versus equities and its downside turned significantly negative. Additionally, correlations between the two assets dropped to around its long-term historical average. In essence, Bitcoin has had a mind of its own over the past month as it has been responding more from idiosyncratic factors than systematic ones.

Lastly, we examine the importance of the outcome from the election. As we discussed, the new administration has been vocal advocates of Bitcoin and Crypto currency in general. As we saw earlier, Bitcoin has essentially been on a straight ride up since the election, given the positive sentiment that the new administration has provided around the prospects of Bitcoin and Crypto. As expected, we can see its up capture shot up exponentially versus equities and its downside turned significantly negative. Additionally, correlations between the two assets dropped to around its long-term historical average. In essence, Bitcoin has had a mind of its own over the past month as it has been responding more from idiosyncratic factors than systematic ones.