Individual Assets or Diversified Strategies?

The Final Lap of 2023

As potential for market volatility looms amidst continued rising rates and geopolitical conflict, we believe investors are faced with a dilemma – do you expend the time to research individual assets for opportunity or do you pay for portfolio models, which may include additional expenses from the investment vehicles used? During times of turbulation, we believe it typically serves investors well to be highly diversified. Because of this, it may require extensive time conducting research to build a portfolio of securities if one were to choose to manage their investments themselves. Alternatively, purchasing a portfolio of exchange traded funds or mutual funds may erode your return potential due to management fees charged on the funds themselves.

How Each Approach Compares

Let’s first pinpoint how we define volatility. Volatility, which is a measurement of how swiftly prices move in the market, can be measured in a variety of ways. One way that many investment professionals measure volatility is through the Chicago Board Options Exchange Volatility Index (the “VIX”), which measures the short-term options activity in the S&P 500 Index. The greater the price in the VIX, the greater expected market volatility. We believe that a price of $30 or higher in the VIX is an indication of high volatility. We do not have to look far back to see the last time that occurred (September 2022):

Source: Bloomberg LP. Graph depicts the daily price of the VIX from 10/24/21 through 10/24/23.

As we discussed, we are trying to determine if a broad portfolio of securities serves investors better than trying to identify individual securities during times of volatility. As a barometer, we will measure the S&P 500 Index, which is a composition of U.S. large cap securities, versus popular individual securities in the months following the VIX surpassing $30.

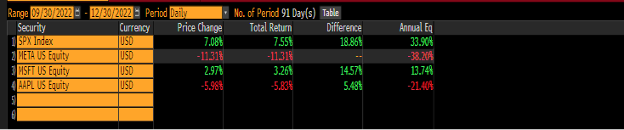

Source: Bloomberg LP. Graph depicts the overall return of the S&P 500 Index (“SPX Index”), Facebook (“META”), Microsoft (“MSFT”), and Apple (“AAPL”) for the period between 9/30/2022 and 12/30/2022.

As you can see from the above chart, the S&P 500 Index (“SPX Index”) outperforms each Microsoft (“MSFT”), Apple (“AAPL”), and Facebook (“META”); which represented 3 of the top 10 holdings in the S&P 500 Index as of 09/30/2022, individually in the months following the VIX surpassing $30. We believe this is just one example that supports the thesis that a broader array of securities may be more beneficial compared to individual securities in times of volatility.

What to do

As of 10/23/23, the price of the VIX was $20.37, which suggests little to no volatility is expected in the market. However, as you can observe from the VIX chart above, those circumstances can change rather quickly. Given the current macro environment between the uncertainty in federal monetary policy as well as escalating geopolitical conflict, we believe volatility may rear its ugly head sooner than later. Because of this, we believe utilizing a diversified portfolio of securities is generally better suited for investors than attempting to research and select stocks individually.