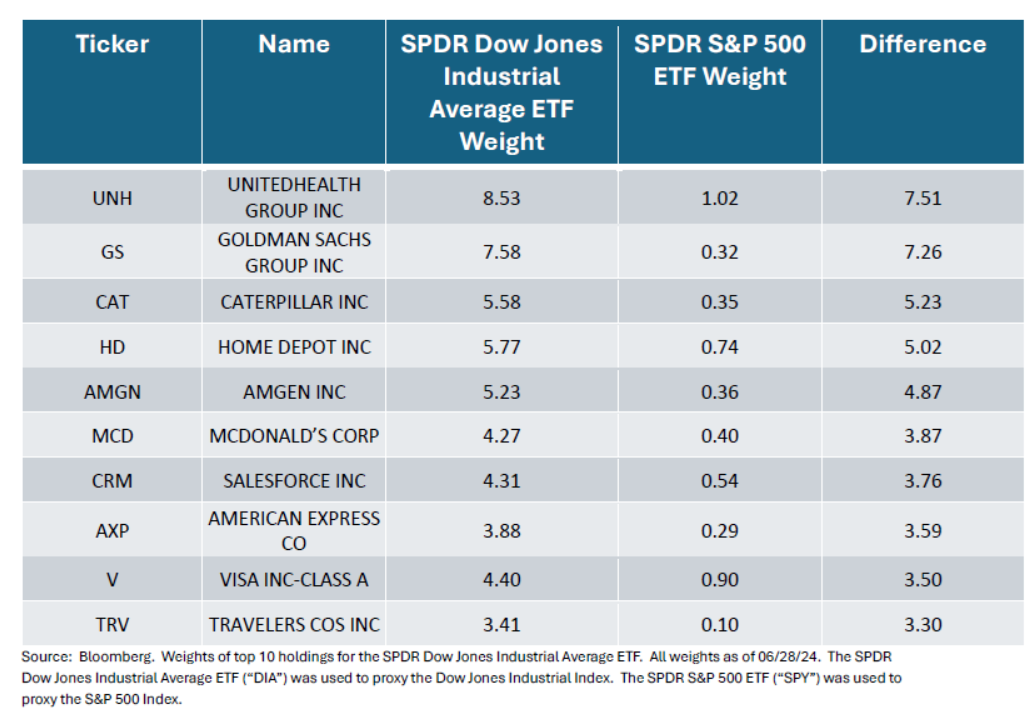

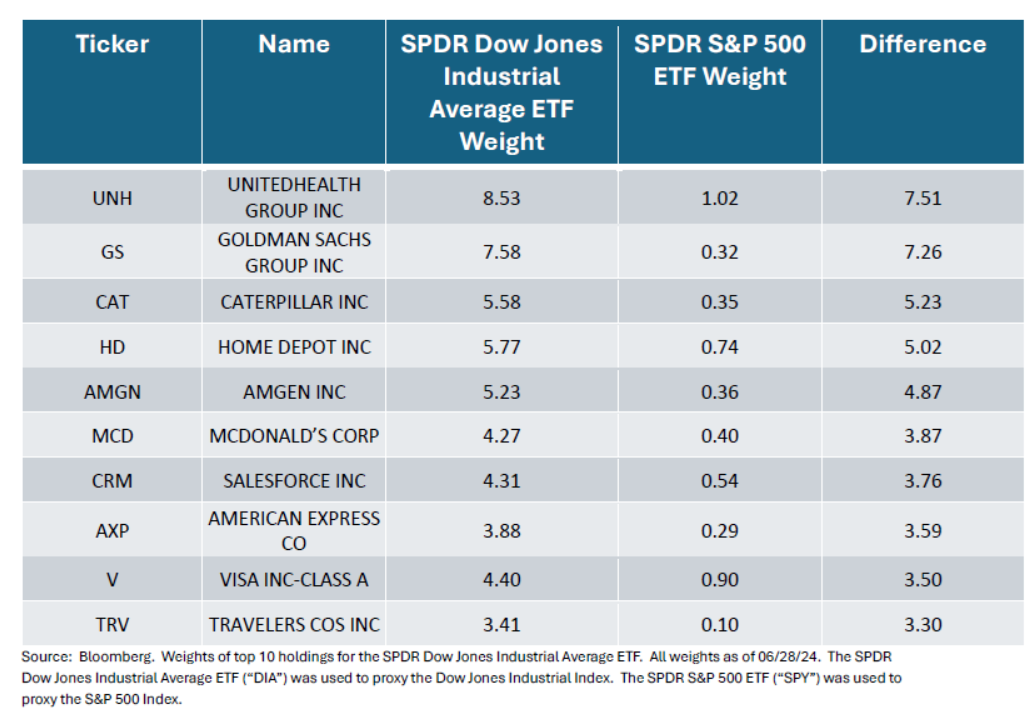

The Dow Jones Industrial Average is the oldest U.S. stock market index. The 30-stock index was first introduced on May 26, 1896 and has generally been used as a barometer for the health of the U.S. financial markets. In our opinion, a fatal flaw in the Dow Jones Industrial Average is that it is weighted by price, thus making it susceptible to radical shifts in its stocks weights from stock splits and/or issuances. While the 30 stocks in the Dow Jones Industrial Average are all held in the S&P 500 Index, you can see the radical differences in weights between the two indexes:

As we can observe just from the top 10 holdings of the Dow Jones Industrial Average, there is significant tracking error between the two major indexes. In fact, the Dow Jones Industrial Average has an approximate 24% active share in its top 10 holdings versus the weightings of those stocks in the S&P 500.

Why the Divergence

Of course, part of the tracking error can be attributed to the fact that the Dow Jones is only 30 stocks versus the S&P 500 holding 500 stocks. However, the number of stocks is not as large of a contributor to the tracking difference as you would think. Let’s take a look at how the indexes would line up if the Dow Jones were market cap weighted:

As we can see from the above, tracking error was reduced by nearly 75% by weighting the Dow Jones by market capitalization as opposed to its price weighting method. In fact, the Dow Jones with a market capitalization weighting approach only had a roughly 6% active share to the S&P 500.

Fallacies of Price Weighting

Now that we have established how price weighting has created significant divergence between the Dow Jones and the S&P 500, we must ask – what are the fallacies of price weighting an index? Similar to market capitalization, the price of a security is indicative of how the security is performing. Thus, we feel that we can draw the conclusion that weighting an index by market capitalization or by price tilts the index’s exposure to securities that have performed the best recently. Some may say that those types of indexes are “performance chasers”. In our opinion, either approach generally ignores the company’s fundamentals or financial health in favor of following investor demand. However, it can be argued that weighting by a company’s market capitalization is a form of momentum, which is a factor that can contribute positively to performance. Price, on the other hand, can be artificially influenced by corporate actions, such as stocks splits and share offerings. That is, when you increase or decrease the company’s outstanding shares, the actual market value of the company does not change, but the price of the security does change.

For example, if a company is worth $1,000,000 and has 10,000 shares outstanding; the price of the company is $100 ($1,000,000 divided by 10,000 shares). If, however, the company announces a 2:1 stock split; that would mean it will issue each shareholder 2 shares for every share held. In other words, the outstanding shares would grow twice the size from 10,000 to 20,000. Therefore, the stock price would decrease to $50 ($1,000,000 divided by 20,000 shares). Conversely, the company could announce a 1:2 stock split, which would mean shareholders would forfeit 2 shares for every share held. Therefore, the shares would be cut in half from 10,000 shares to 5,000 shares. Consequently, the price would increase to $200 ($1,000,000 divided by 5,000 shares). Notice in both instances, the value of the company remained at $1,000,000; however, the price varied because the denominator (the shares) fluctuated with the issuance of new shares and the reduction of outstanding shares. Again, the value of the company remained exactly the same. Therefore, not only do we believe that price weighting is a highly inefficient way to compose an index, but it will also further tracking error from other traditional indexes that are market cap weighted.

Divergence

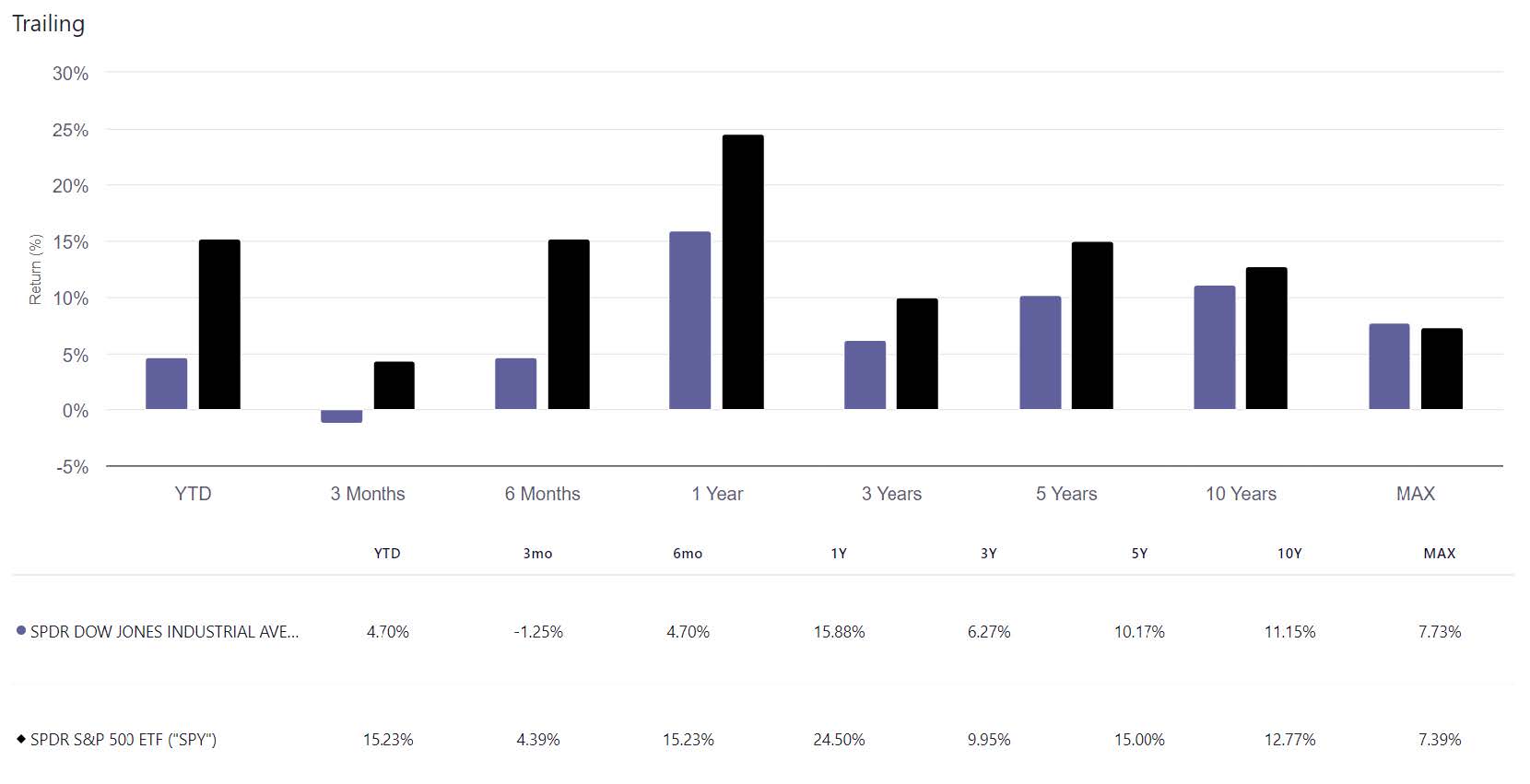

As we discussed, there is a substantial difference between price weighting an index and market cap weighting an index. However, the different weighting methodologies have historically not created a significant difference in performance. Although, recently, that divergence has started to take hold. As we can see from the performance table below, the annualized return from April 2000 through June 2024 has been pretty close between the Dow Jones and the S&P 500. However, as you focus on the recent trailing periods, that performance gap has widened quite substantially.

We believe this divergence has largely been driven by the fact that mega cap stocks (i.e.: stocks with a market capitalization of $200 billion and higher) have been large drivers of performance in the U.S. market. Of course, a price weighted index will be underweight to mega cap stocks compared to market capitalization weighted indexes as mega cap. This is because as a company grows its market capitalization, and potentially splits its stock, the price weighted Dow Jones Industrial index reduces its weight to that security, while the market cap weighted S&P 500 index continues to weight that stock in line with its market capitalization. Again, this is not to say weighting an index by market capitalization is the most efficient method. In fact, we would argue the opposite. However, for purposes of discussion as to whether the Dow Jones Industrial Average Index ought to be a barometer to U.S. market performance; it’s becoming increasingly clear to us that the price weighted approach is significantly impairing its ability to be an index of significance. Therefore, in our opinion, we ought to re-examine how we characterize the performance and health of the U.S. financial markets. To that end, we believe we should no longer be referencing index point movements in the Dow Jones Industrial Average index as a means of describing the condition of U.S. financial markets.

By: Justin Lowry, President & CIO

Disclosure

All discussion regarding the SPDR Dow Jones Industrial Average ETF and the SPDR S&P 500 ETF are for illustrative purposes only.

Not an offer: This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to consult with the professional advisor of their choosing.

Forward looking statements: Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.